What the IRA Provides for Geothermal Technologies

Our busy office had several staffers regularly looking for funding opportunities including a project manager that brought me a file and said that his project owner had just inquired about a 30% federal tax credit for his new home geothermal heating and cooling system. I laughed and said that I would eat my hat the day the federal government pulled off any such tax credits for the geothermal heat pump industry. Our project manager persisted, so I said that if you would bring we written proof that there was such a program, I would listen.

The next day, he brought me the proof and I was amazed! We had no idea at the time how it would change our business operations over the next 14 years. Through a charmed sequence of events since then, Egg Geo went through a metamorphosis that propelled us into nationwide and worldwide operations that include education, code writing, consulting engineering, advocacy, legislative development, and the writing of two geothermal engineering textbooks for McGraw-Hill education. Here we are with another round of impressive incentives coming from the Federal Government under the new IRA and ITC packages. Let’s delve into those.

The Inflation Reduction Act of 2022 (IRA) provides $369 billion for energy spending and climate change measures. It's interesting to note that this time, these provisions are intended to increase employment, and provide real and measurable support toward achieving a net zero nation by the year 2050.

Besides helping to ensure that the tradespeople that install our decarbonization measures receive a true living wage, the funding mechanisms allow not only for tax credits, they also direct payments of incentives to tax-exempt and government agencies in lieu of just a simple reduction of tax liability through credits. Additionally, the program provides funding for climate grants and assistance for technical education.

- The incentives have been increased for use of US made materials and heat pump equipment. Additionally, funding is available for siting facilities in economically-disadvantaged areas.

- Project funding is uncapped when the project meets the requirements for paying prevailing wages and employment of qualified trade apprentices.

- The investment recovery act provides energy tax credits that are for a longer term than those in the past. Previously, energy credits were authorized for a limited number of years and then received periodic extensions. The IRA provides for some short term extensions to many of the specific tax credits until 2025. The geothermal exchange systems are the exception, receiving full credits through 2034.

- There are many tax incentives included in the investment recovery act that allowed direct payments in lieu of tax credits for tax exempt and governmental organizations.

- Entities with low tax liability have the option to monetize these credits by transferring them to an entity with larger tax burdens, such as an Energy Services Company (ESCO).

There is particularly relevant verbiage that provides investment tax credits for ground-coupled & groundwater projects. Similar to solar power generation, energy storage, and combined heat and power, the IRA also includes incentives for nuclear power and hydrogen production. It's understood that these incentives primarily reduce the cost for Needs+1 applications that utilize hybrid fuel input.

This is a good segway into a little known resource that hit our radar in 2009, the Database of State Incentives for Renewables & Efficiency® (DSIRE) https://www.dsireusa.org/ DSIRE is the most comprehensive source of information on incentives and policies that support renewable energy and energy efficiency in the United States. Established in 1995, DSIRE is operated by the N.C. Clean Energy Technology Center at N.C. State University. The navigation is not entirely intuitive, so here’s a navigation video: https://youtu.be/__iCPPF8rcE

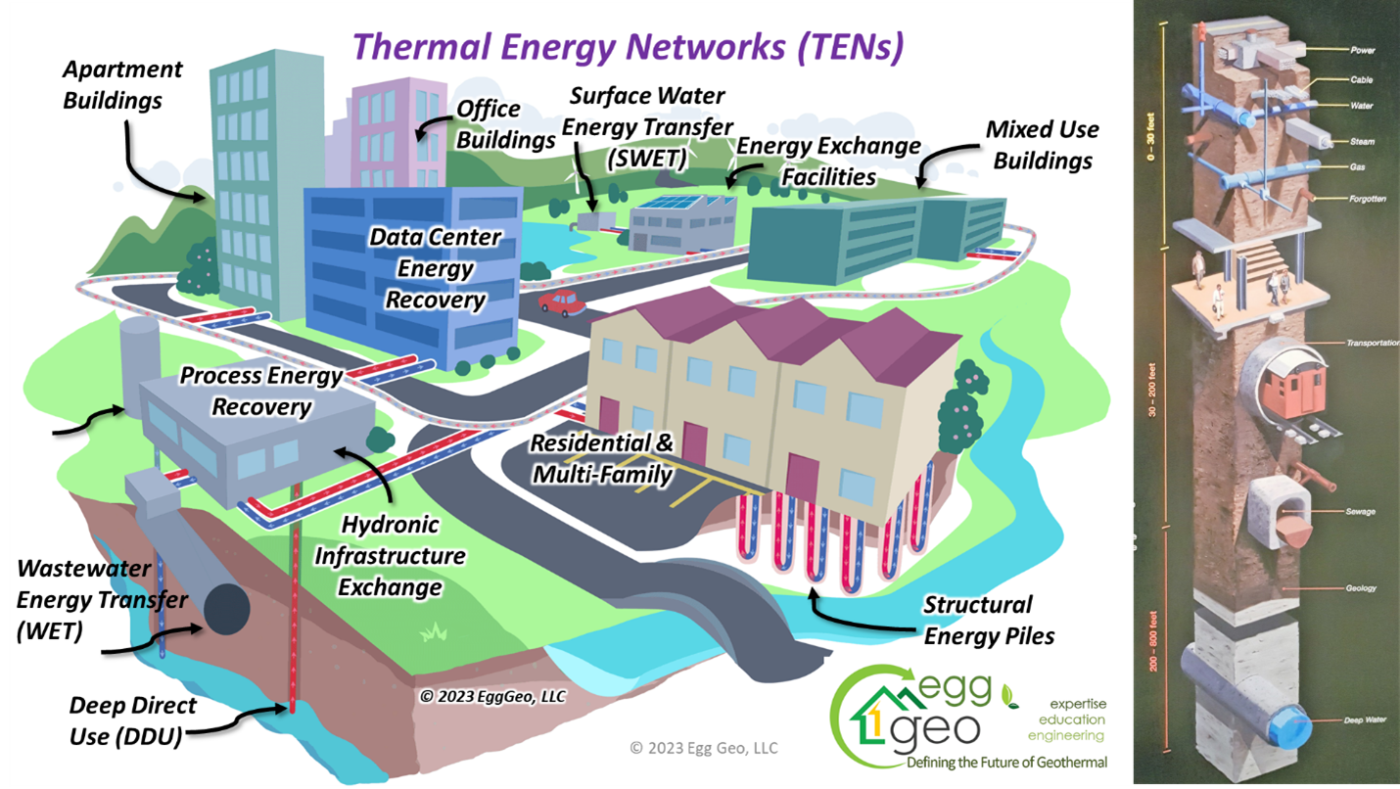

The IRA includes extensions for the investment tax credit (ITC) and for the production tax credit (PTC). Any projects that want to take advantage of these extensions must begin construction before January 1st, 2025, unless it's for geothermal exchange systems, which have been extended to January 1st, 2035. Geo exchange systems are low temperature, shallow exchange systems that serve building heat pumps and thermal energy networks. Because of the massive push toward distributed thermal energy, or Thermal Energy Networks (TENs), disadvantaged communities will have access to clean heating, cooling & domestic hot water (DHW) with a simple utility connection.

Thermal Energy Networks (TENs) are utility-scale infrastructure projects that connect multiple buildings into a shared network with sources of thermal energy like geothermal boreholes, surface water, and wastewater. Utilization of these energy networks seems to be the final frontier for community renewable energy systems. Because buildings are responsible for 40% of carbon emissions, the answer to eliminating those lies in distributing the thermal energy using hydronic pipelines through our cities and allowing energy and other utilities to maintain and bill for the services of these TENs.

The greenhouse gas reduction fund has been established with $27 billion to provide grants and technical assistance to dot-orgs, tribal governments, and other nonprofit organizations. Notably, $15 billion is set aside for financial and technical assistance to disadvantaged and low-income communities.

During the vetting. For the 2009 stimulus package, we were able to determine in practice that the tax credits applied to 100% of the new construction and retrofit costs involved in a geothermal upgrade to a facility or home. This included electrical, controls, pumping, piping, heat pump and chiller equipment, labor, permits and everything else with the exception of the forced air distribution system, or in other words the duct work. So far, it looks as though the IRA will be similar in its extent for incentives going forward.

Kristy Egg holds a Bachelor of Science degree in Public Health with two areas of focus: health science and epidemiology. Over the past decade Kristy studied and developed competency in the public health issues of opportunistic waterborne pathogens and biofilms in water systems, including Legionellosis. For the past two years she has dedicated most of her time to helping educate and bring about workable solutions for disadvantaged communities. Her strengths are research, Indoor Air Quality (IAQ), Ambient Air Quality (AAQ), & management of community projects, team cat herding, some balloon animals, and marketing. She can be reached at kristy@egggeo.com

Jay Egg is a geothermal consultant, and President of Egg Geo, LLC. He has co-authored two textbooks on geothermal HVAC systems published by McGraw-Hill Professional. He can be reached at jegg@egggeo.com